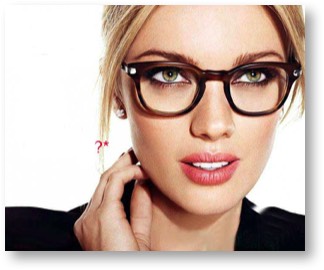

Have A Flexible Spending Account? Don’t Let Your Flex Spending Dollars Go To Waste

The Spectrum is now accepting FSA and HSA debit cards for all prescription glasses and contact lenses purchases

Flex Spending Money for Eye Care and Eye Wear

Your Flex Spending Account covers eye care and eye wear. Your Flexible Spending Account dollars can be used for many different vision related services and products, including:

Reading glasses with corrective lenses ,Prescription eyeglasses for computer work ,Prescription safety eyewear ,Prescription sunglasses

Flexible Spending Accounts are a great way to stock up on contact lenses and supplies, including coloured and special effects lenses as long as you have a current prescription.

Schedule an Appointment for You or Your Family

Don’t let your flexible spending account dollars go to waste before the end of the year. To help maintain healthy vision for you and your family please schedule an appointment today!

Now is the perfect time to schedule a Smile, iLASIK, PRK, or any other vision-corrective surgery.

Flex Spending Account Q&A

-

Can I save tax money if I elect to have laser or implant vision correction?Yes, there are two ways you can save tax dollars with laser or implant vision correction:

- By deducting the procedure as a medical expense OR

- By utilizing your company's Health Spending Account (HSA)

-

What is a Flex Spending Account (FSA)?A Health Spending Account (FSA), is an employer-sponsored benefit that allows you to pay for eligible medical expenses on a pre-tax basis. If you expect to incur medical expenses that won't be reimbursed by your regular health insurance plan, you can take advantage of your employer's HSA, if one is offered. FSAs are also called flex plans, reimbursement accounts, Medical Spending Accounts, or a Cafeteria Plan.

-

What is the benefit of using Health Spending Accounts?HSAs save you money by reducing your income taxes. The contributions you make to a Health Spending Account are deducted from your pay before your federal, provincial taxes are calculated and the contributions are never reported to Revenue Canada. The benefit is that you decrease your taxable income and increase your spendable income, which can save hundreds or even thousands of dollars a year.

-

How do I know if I have access to a Health Spending Account?First, check with your human resources administrator at your workplace. Then find out if there is a maximum contribution amount and ask when you are eligible to enroll.

-

How does a Health Spending Account work?At the beginning of the plan year (which usually starts January 1st), your employer asks you how much money you want to contribute for the year (there are limits) into your Flexible Spending Account. You have only one opportunity a year to enrol, unless you have a qualified"family status change," such as marriage, birth, divorce or loss of a spouse's insurance coverage. The amount you designate for the year is taken out of your pay-check in equal instalments each pay period and placed in a special account by your employer. As you incur medical expenses that are not fully covered by your insurance, you submit a copy of the Explanation of Benefits or the provider's invoice and proof of payment to the plan administrator, who will then issue you a reimbursement check.

-

How can I be sure the money I put aside towards vision correction in my Health Spending Account (HSA) will be used?Before committing any money to a HSA for vision correction, we recommend you come in to have a FREE consultation to ensure you are a candidate. Once that has been determined, you can confidently allocate pre-tax dollars to your HSA.

-

How do I find out if I'm eligible for laser or implant vision correction?To see if you are a candidate for laser or implant vision correction, please contact The Spectrum Eye Centre Partners of FYIdoctors at 1-306-586-EYES (3937) or 306-761-EYES (3937) to schedule a consultation.

-

I am a first time patient, what do I do?

SCHEDULE AN APPOINTMENT

We are here to guide you through your first visit with us!

Welcome! We are so glad you have chosen the The Spectrum Eye Centre for your visit. We are here to make your first visit streamlined and easy, and hope to exceed your expectations!

Below are a few tips on what to expect for your first visit with us:

You may fill out your intake forms in advance!

Please visit our forms page to be even more prepared for your first visit. There you can fill out your intake forms in advance of your scheduled appointment saving you time upon your arrival.

What should I bring to my appointment?

• All prescription glasses, contact lenses and sunglasses

• A list of all prescribed and over the counter medications and nutritional supplements

• Your vision and medical insurance cards

• Your picture I.D.

• Any referral forms from your medical doctor

• Any questions and concerns

• Be prepared to provide any co-payments at the time of service

Open all Close all